We all love getting more bang for the buck. What’s more rewarding than the miles, points and cashback which we receive from credit cards? It is getting further rewards by paying off your credit card dues with debit card!

Based on the card we may hold; we could get additional returns. We are going to talk specifically about paying off your credit card dues with SBI Debit Card – Wealth Visa Signature variant.

SBI Wealth Debit Card Returns

SBI Wealth Debit Card is issued to account holders of SBI’s affluent banking product: Wealth Savings Account. One may be eligible if we hold total assets across Deposit or Investments (Mutual funds, Demat Holdings and Insurance Premium) of Rs 10 lakhs (need to increase to Rs 30 lakhs within a period of 12 months).

This information is not available on the SBI website either, but it is based on my personal experience and the points I have accumulated over the many years that I have had this debit card. For every Rs 200 spent, we receive two points. There is a limit of 100 points for every transaction and we can earn up to 1000 points per month. This means we could do 10 transactions of Rs 10,000 each for a total spends of Rs 100,000 to earn 1000 points. Spending during the birthday month earns an extra 200 points.The value of each point is 25 paisa. The most we can earn each year, including the birthday bonus, is Rs 3050. Cannot get very excited but these returns go above and beyond what we can obtain from credit cards.

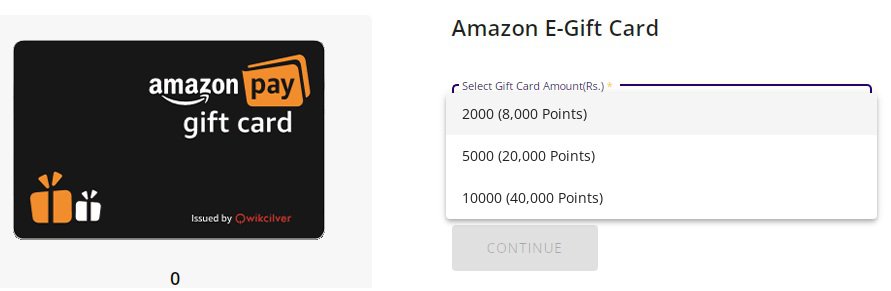

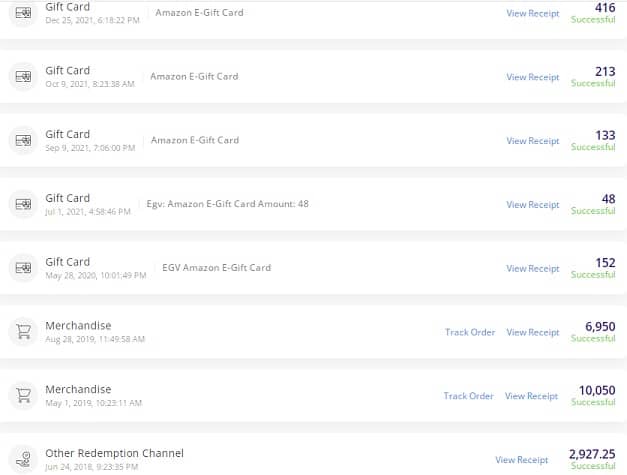

These reward points get accrued in SBI Rewardz. I would value these points at face value since we could can redeem them for SBI Prepaid Gift Card or Amazon eGift Voucher. We may redeem for any other brand gift voucher as well. Previously, we could redeem for any amount, but as of now, I can only see Amazon e-Gift card for amounts over Rs 2000. SBI Prepaid gift cards start at Rs 500, but there is a Rs 50 shipping charge.

These are my redemption over the years however earning like this would be few and far between as they have devalued this program over time.

Paying Credit Card Bill with Debit Card

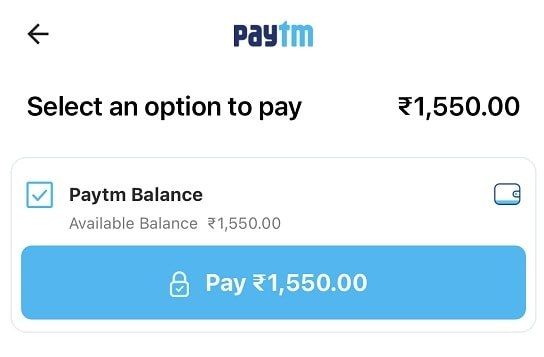

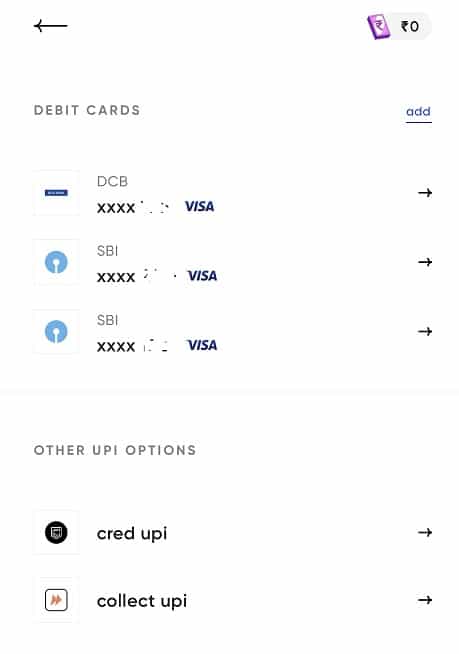

I pay my credit card outstanding on Paytm. However, we cannot pay directly but have to load the Paytm Wallet by debit card (without any charges) and then use that balance to pay the bills. The easiest way to go about doing this is load Rs 10,000 ten times and pay the outstanding from this Wallet balance.

There is another way which I use in case there is more than Rs 100,000 outstanding or to be settled. I use CRED. However, CRED could be used for payments over Rs 50,001. We do get additional cashback from CRED,but it’s not worth the effort because the amounts are small.

Bottomline

When using a debit card to pay a credit card bill, we get rewards in addition to those we would get from using a credit card. I can vouch for the fact that we would receive points for both CRED and Paytm. Naturally, these aren’t the only options, but they are the only two that I trust and a simple way to receive Rs 250 each month.